I love to do a financial audit with my clients throughout the year.

I know a lot of business owners love to take advantage of sales (especially around Black Friday) from tool and software companies.

But, you need to make sure you’re still using those tools before you get charged again (and at full price). Especially because small subscriptions can add up faster than you realize.

A tactic I like to help my clients with is to set reminders a week before a payment is due using a tool like Asana. While I’m not a bookkeeper, as a Studio Manager, I’m often in my client’s inbox taking note of “upcoming payment” reminders.

I’ll mark these upcoming payments in Asana, giving my clients a chance to re-evaluate their subscriptions and decide if they still need the service, or if it’s time to downgrade the tier or cancel altogether.

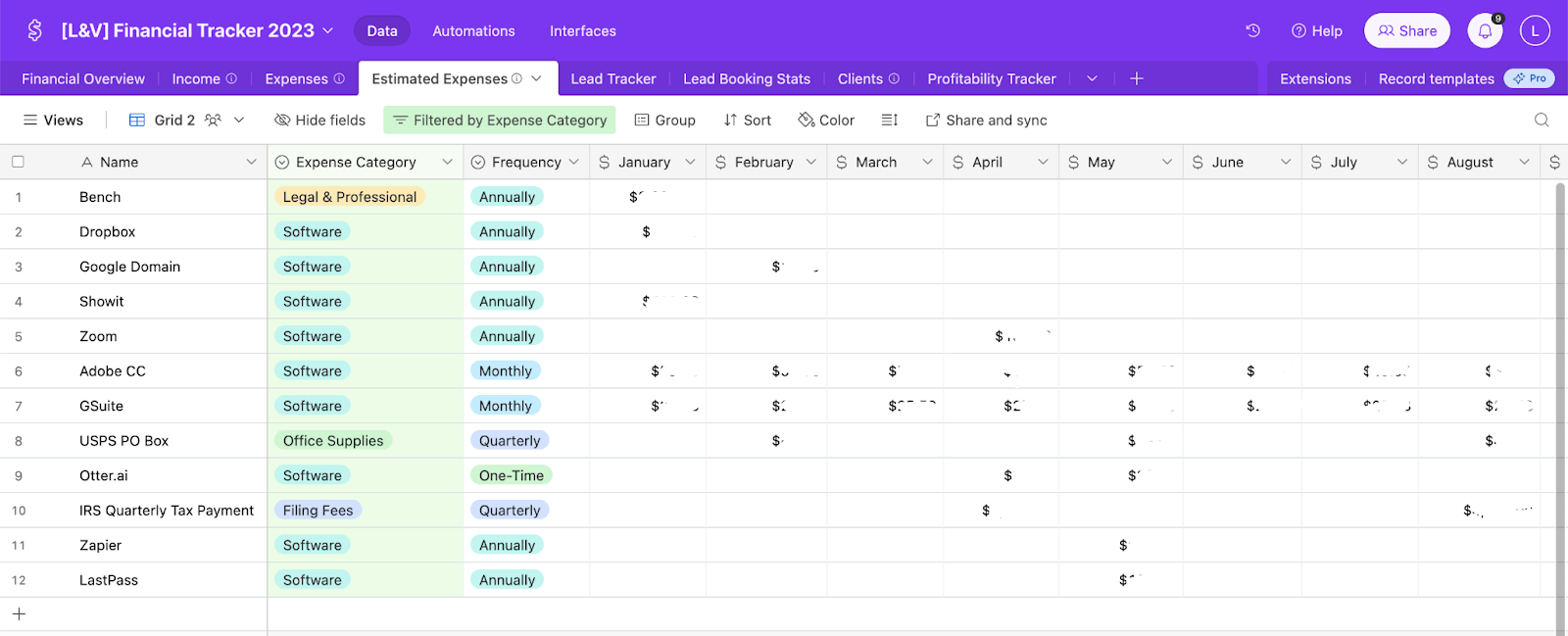

You can also visualize your expenses using an Airtable tracker. Here’s an example of what it can look like (you can also replicate this in a Google Sheet).

This simple but highly effective tool will help you see a clear overview of your estimated monthly expenses. It’s like having Truebill, but for your business.

Now, when you’re evaluating your recurring expenses, here are a few questions to ask yourself:

- What’s the cost? Assess whether it’s a monthly or annual expense. The majority of the time, if you pay annually you’re saving money.

- Usage assessment — How many people on your team are actually using each tool? Is it a tool you could create a master team account for instead of paying per user?

- Value analysis — Is the tool truly integral to your workflow, or do you have it more as a “just in case” tool? Could it be replaced by a more cost-effective option, or do you already pay for another tool that has a similar feature?

- Usage frequency — Do you use this tool enough to justify the ongoing cost? If not, consider switching it to an as needed basis. For example, I had an Otter.ai subscription for transcribing calls. I realized I never actually went back and used them, so I got rid of the subscription and now, if I do need it, I can always get it for a month and then cancel when I don’t need it anymore.

- Explore alternatives — There are so many tools out there that are nearly the same, so always keep an eye out for alternatives that offer more valuable features or align better with your needs.

Creating a more profitable business (especially, if it’s been a slower year) comes down to optimizing your expenses. By conducting a financial audit of your business, you can make sure your business is running as lean as possible.

Happy canceling + streamlining!

leave one here

comments